The Definitive Resource for hard money lenders in Atlanta Georgia

The Definitive Resource for hard money lenders in Atlanta Georgia

Blog Article

The Effect of a Hard Money Loan on Realty Financing Techniques

In the complex sector of genuine estate funding, hard Money lendings have arised as a potent tool, using investors a fast course to funding. Understanding the ins and outs of difficult Money finances is important for investors looking to take full advantage of returns while mitigating risks.

Recognizing the Principle of Hard Money Loans

Although commonly misconstrued, hard Money lendings play a crucial function in the realty industry. They are short-term financings provided by personal financiers or firms, based on the worth of the building being purchased rather than the borrower's creditworthiness. The funds are typically utilized for restoration or building and construction of realty properties. These finances are characterized by their high rates of interest and much shorter repayment periods compared to typical loans. Hard Money car loans are often the best choice for real estate investors that require quick financing or those with inadequate credit rating. Recognizing the intricacies of tough Money finances is important for any kind of investor or designer as it can open up new methods for property financial investment and advancement.

The Advantages and disadvantages of Hard Money Loans in Property

Difficult Money financings in property included their one-of-a-kind collection of advantages and possible dangers (hard money lenders in atlanta georgia). A close exam of these elements is vital for investors interested in this kind of financing. The following conversation will intend to shed light on the benefits and drawbacks, offering a comprehensive understanding of hard Money car loans

Reviewing Hard Money Benefits

Regardless of the prospective challenges, hard Money lendings can supply substantial advantages genuine estate investors. The key benefit hinges on the rate and simplicity of obtaining these fundings. Unlike standard lenders, tough Money loan providers do not concentrate on the borrower's credit reliability. Instead, they focus on the residential property's value. This implies that Loan authorization and financing can take place within days, not weeks or months. In addition, tough Money car loans offer versatility. Customized Funding terms can be worked out based on the investor's one-of-a-kind requirements and job specifics. An additional advantage is the absence of earnings confirmation. For capitalists with uneven income yet significant equity in their building, this can be an actual advantage. These benefits have to be evaluated against prospective disadvantages, which will certainly be talked about later.

Understanding Possible Finance Dangers

While hard Money lendings provide luring advantages, it is vital to comprehend the integral threats involved. Additionally, the home, which serves as the Finance collateral, is at risk if payment stops working. The approval of a Hard Money Lending is mainly based on the home value, not the consumer's creditworthiness, which might motivate risky monetary behavior.

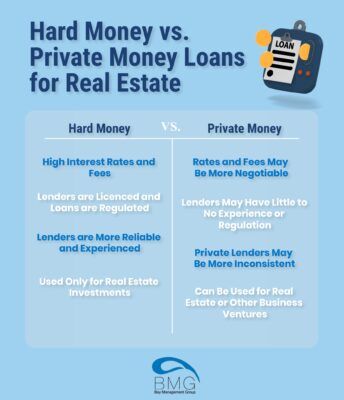

Contrasting Difficult Money Financings With Standard Funding Choices

Just how do tough Money car loans compare to typical financing choices in the property industry? Hard Money lendings, often looked for by financiers for fast, short-term funding, are identified by their rapid approval and funding procedure. Conversely, pop over to this web-site conventional financing alternatives, such as small business loan, offer reduced rate of interest yet require a more see this website strenuous approval procedure. While tough Money loan providers concentrate on the home's potential worth, conventional lending institutions scrutinize the customer's credit reliability, debt-to-income, and earnings ratio. An additional essential distinction hinges on the payment term. Difficult Money car loans commonly have a shorter term, normally around twelve month, while typical lendings can reach 15 to 30 years. The option in between these 2 choices is commonly determined by the capitalist's timeline, risk resistance, and project nature.

Instance Studies: Successful Realty Deals Moneyed by Hard Money Loans

Many success stories in the real estate market highlight the critical application of difficult Money car loans. A programmer in Austin, Texas secured a Hard Money Financing to acquire a worn out residential property. The fast funding enabled him to outbid competitors, and the home was successfully refurbished and offered at a significant profit. In an additional instance, an investor in Miami had the ability to close a bargain on a multi-unit domestic structure within days, many thanks to the quick authorization procedure of a Hard Money Loan. These scenarios highlight the duty tough Money car loans can play in helping with profitable realty offers, vouching for their critical significance in realty financing.

Just how to Safeguard a Hard Money Finance: A Step-by-Step Overview

Safeguarding a Hard Money Finance, just like the Austin programmer and Miami investor did, can be a substantial game-changer in the actual estate market. After selecting a lending institution, the debtor must offer a compelling case, normally by demonstrating the possible profitability of the property and their capacity to pay off the Funding. When the lending institution accepts the proposition and reviews, the Loan agreement is drawn up, signed, and funds are disbursed.

Tips for Optimizing the Perks of Hard Money Loans in Realty Investment

To manipulate the complete possibility of hard Money lendings in realty investment, wise financiers use a variety of techniques. One such method involves using the quick approval and financing times of hard Money fundings to capitalize on financially site web rewarding deals that call for fast action. Another method is to utilize these car loans for building renovations, therefore raising the worth of the building and potentially attaining a greater price. Financiers need to likewise bear in mind the Financing's conditions and terms, ensuring they are suitable for their financial investment strategies. It's sensible to build healthy relationships with tough Money loan providers, as this can lead to extra favorable Funding terms and potential future financing opportunities. These approaches can optimize the advantages of difficult Money financings in the actual estate market.

Conclusion

To conclude, tough Money fundings can be a powerful tool in an investor's funding arsenal, giving fast accessibility to capital and facilitating revenue generation from improvement or acquisition projects. Their high-cost nature necessitates detailed due diligence and calculated planning. Financiers have to make certain that potential returns validate the involved dangers which they have the capacity to manage the brief settlement timelines effectively.

These car loans are identified by their high interest rates and much shorter repayment periods compared to conventional fundings. Tough Money fundings are commonly the best option for actual estate financiers that require fast financing or those with poor credit report history (hard money lenders in atlanta georgia). Understanding the ins and outs of hard Money financings is crucial for any actual estate investor or programmer as it can open up brand-new opportunities for home financial investment and growth

Hard Money fundings typically have a much shorter term, normally around 12 months, while typical finances can prolong to 15 to 30 years. These situations underline the function tough Money loans can play in assisting in successful actual estate deals, attesting to their calculated value in actual estate funding.

Report this page